CAM Charges can be the hidden villain in your business budget, silently creeping up and impacting your bottom line. Understanding the ins and outs of Common Area Maintenance fees is crucial for any business owner navigating commercial leases. From unraveling the mysteries of CAM Charges to negotiating with landlords, this ultimate guide will equip you with the knowledge needed to take control of your expenses and make informed decisions for your business. Let’s dive into the world of CAM Charges and unlock their secrets together!

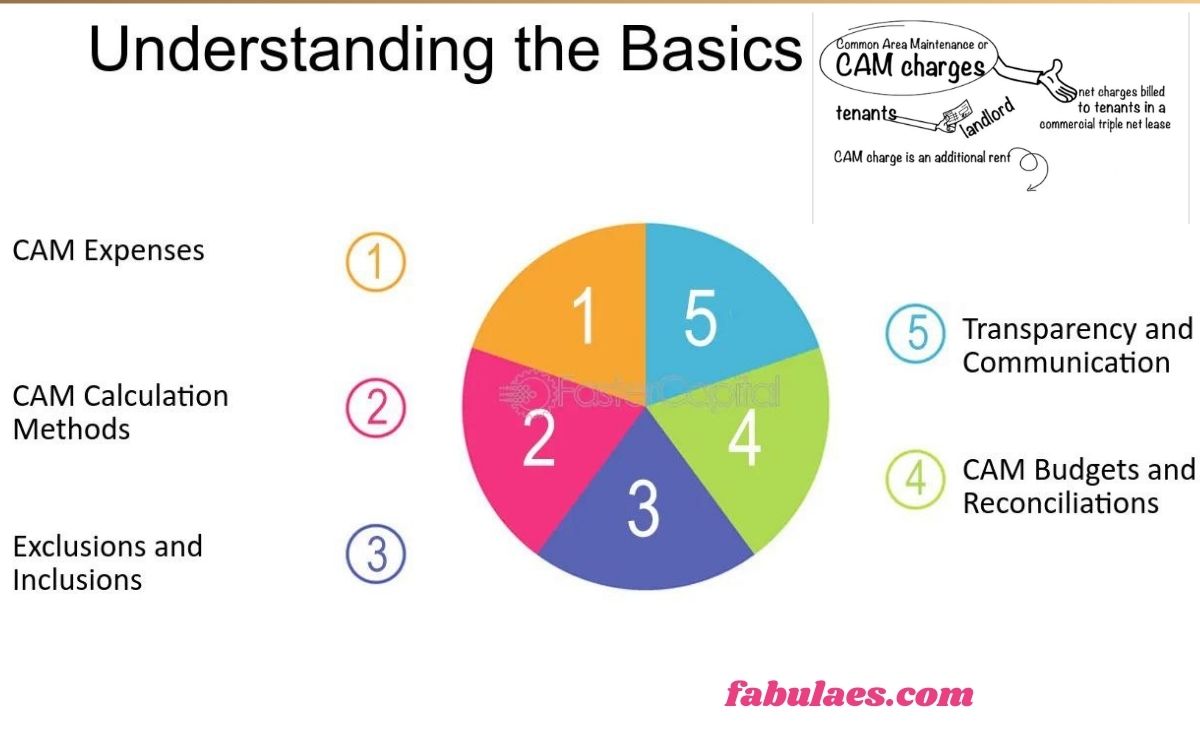

Understanding CAM Charges

When leasing commercial space, it’s essential to grasp the concept of CAM Charges. Common Area Maintenance fees cover costs associated with maintaining shared spaces like lobbies, hallways, and parking lots within a commercial property. These charges are typically divided among tenants based on their leased square footage or as a percentage of total building occupancy.

Understanding CAM Charges is crucial for budgeting purposes and forecasting expenses accurately. By knowing what expenses are included in CAM Charges, such as landscaping, security, and utilities for common areas, businesses can anticipate additional costs beyond rent.

CAM Charges can vary depending on the property type and lease agreement terms. It’s important to carefully review your lease to comprehend how CAM Charges are calculated and what services they encompass. Being informed about these charges will help you manage your business budget effectively while ensuring transparency in your landlord-tenant relationship.

The Different Types of CAM Charges

When it comes to CAM charges, there are various types that businesses should be aware of. Common Area Maintenance fees can encompass a range of expenses incurred in maintaining shared spaces within a commercial property. Some of the different types of CAM charges include landscaping costs for common areas, cleaning and janitorial services for shared spaces like lobbies or hallways, repair and maintenance of parking lots or garages, as well as security expenses for the overall premises.

Utilities such as water, electricity, and heating/cooling systems servicing common areas may also be included in CAM charges. Additionally, insurance premiums for the property’s common areas and property taxes allocated to shared spaces are commonly part of CAM fees. Understanding these diverse components is crucial for businesses when negotiating leases and budgeting effectively to account for these additional costs beyond base rent.

By familiarizing themselves with the various types of CAM charges that may apply to their lease agreements, tenants can better assess their financial obligations and plan accordingly.

Pros and Cons of Including CAM Charges in Business Budgets

Understanding the pros and cons of including CAM charges in your business budget is crucial for effective financial planning. On the positive side, incorporating CAM charges allows for predictable expenses related to property maintenance, ensuring that common areas are well-maintained without unexpected costs popping up. This can help with budgeting and cash flow management.

However, one drawback is the potential for increases in CAM charges over time, impacting your bottom line. Landlords may also have discretion in how they allocate these charges, leading to potential disagreements or misunderstandings between tenants and landlords. It’s essential to carefully review lease agreements to understand what is covered under CAM charges and negotiate terms that align with your business needs.

Weighing the advantages and disadvantages of including CAM charges in your budget will help you make informed decisions about managing operational costs effectively.

How to Calculate and Control CAM Charges

Calculating and controlling CAM charges is crucial for businesses looking to manage their budget effectively. To calculate these charges, start by understanding the lease agreement and identifying what expenses are included in the CAM fees. Typically, common area maintenance costs cover services like landscaping, snow removal, security, and property management.

To control CAM charges, review your lease carefully to ensure that you are only paying for expenses that directly benefit your space. Keep track of all communication with your landlord regarding CAM charges and request detailed invoices or receipts for any additional costs incurred. It’s also essential to regularly audit the expenses outlined in your lease agreement to verify accuracy.

By staying informed about how CAM charges are calculated and being proactive in monitoring them, business owners can better anticipate and manage these extra costs within their budget constraints.

Negotiating CAM Charges with Landlords

Negotiating CAM charges with landlords can be a crucial aspect of managing your business budget effectively. When entering into a commercial lease agreement, it’s essential to carefully review the CAM provisions and understand the breakdown of costs included.

One strategy for negotiating is to clarify what expenses are considered legitimate maintenance costs versus capital improvements. This transparency can help ensure you’re not overpaying for services that should be covered by the landlord.

Another approach is to propose a cap on annual CAM charge increases to avoid unexpected spikes in expenses. By setting clear parameters upfront, both parties can have more predictability in budgeting for operating costs.

It’s also beneficial to discuss how common areas are being utilized and whether adjustments can be made to reduce unnecessary expenditures without compromising the quality of maintenance provided.

Open communication and negotiation skills are key when addressing CAM charges with landlords. By advocating for fair terms and seeking clarity on cost allocations, you can better manage your financial obligations within your lease agreement.

Alternative Options to Avoid CAM Charges

Looking to avoid CAM charges in your business budget? Here are some alternative options to consider.

One way to sidestep CAM charges is by negotiating a lease with a gross rent structure. This type of lease includes all expenses, including CAM fees, in one flat rate. It can provide more predictability for your budgeting process.

Another option is seeking out properties that offer net leases, where tenants are responsible for paying their share of operating expenses directly to the service providers. This can give you more control over how these costs are managed and potentially reduce unexpected fees.

You could also explore co-working spaces or shared offices where this may be included in the overall membership fee. This setup can simplify your financial planning and eliminate the need to navigate complex CAM calculations independently.

Considering these alternatives can help you make informed decisions when leasing commercial space and potentially alleviate the impact of CAM charges on your business finances.

CAM Charges: Understanding the Hidden Costs in Commercial Leases

CAM charges, also known as Common Area Maintenance fees, are often hidden costs that can catch commercial tenants off guard. These charges cover expenses for maintaining shared spaces like lobbies, parking lots, and hallways within a commercial property. Understanding the breakdown of this is crucial for businesses to accurately budget their expenses.

Landlords typically pass on these maintenance costs to tenants in addition to base rent. It’s important for tenants to carefully review lease agreements to fully comprehend what expenses are included in and how they are calculated. Failure to do so can result in unexpected financial burdens down the line.

While CAM charges can add up quickly, they play a vital role in ensuring that common areas are well-maintained and functional for all occupants of a commercial property. By staying informed about it and actively managing them, business owners can effectively control their overall leasing costs.

CAM Charges Explained: What Tenants Need to Know

CAM charges, also known as Common Area Maintenance fees, are a crucial aspect of commercial leases that tenants need to understand thoroughly. These charges cover the maintenance and operational costs of shared spaces within the property, such as lobbies, parking lots, hallways, and landscaping.

Tenants should be aware that it can vary significantly from one property to another based on factors like property size, location, and services provided. It’s essential for tenants to carefully review their lease agreements to clearly outline what expenses are included in it and how they will be calculated.

By understanding it upfront, tenants can budget more effectively for their business operations without facing unexpected financial burdens down the line. Additionally, being informed about CAM charges allows tenants to negotiate with landlords for fair terms that align with their needs and expectations.

In essence…

The Ultimate Guide to Navigating CAM Charges in Your Lease

Navigating it in your lease can be a daunting task, but with the right knowledge and strategy, you can effectively manage these costs. To start, familiarize yourself with the different types of it that may be included in your commercial lease agreement. Common types include property taxes, insurance premiums, maintenance fees, and more.

Calculating and controlling it is crucial to avoid unexpected costs impacting your business budget. Take the time to review your lease terms carefully and understand how these charges are calculated to ensure accuracy. Negotiating with landlords on it is also a key step in securing favorable terms for your business.

Consider alternative options such as gross leases or modified gross leases that may offer more transparency on costs without hidden fees like it. By staying informed and proactive in managing it, you can protect your bottom line and make well-informed decisions for your business’s financial health.

Why CAM Charges Matter: A Comprehensive Overview for Tenants

CAM charges matter because they can significantly impact a tenant’s bottom line. Understanding these charges is crucial for tenants leasing commercial spaces. It goes beyond just paying rent; it cover the costs of maintaining common areas in the property.

By grasping the intricacies of it, tenants can better budget and plan their expenses. These fees can include landscaping, cleaning, security, and repairs within shared spaces. Tenants should be aware of what services are covered under it to avoid any surprises.

Being knowledgeable about it empowers tenants to negotiate with landlords effectively. It provides leverage when discussing lease terms and ensures transparency in financial responsibilities between both parties. Tenants must review lease agreements carefully to understand how they are calculated and billed.

Staying informed about it is essential for tenants to navigate commercial leases successfully. Being proactive in managing these costs can help businesses maintain financial stability while occupying commercial real estate space efficiently.

How to Effectively Manage CAM Charges in Commercial Real Estate

Navigating it in commercial real estate can be a daunting task for business owners. To effectively manage these costs, it’s crucial to understand the breakdown of common area maintenance fees and how they impact your budget. Start by carefully reviewing your lease agreement to identify what expenses are included in the CAM charges.

Next, track and monitor all expenses related to common area maintenance throughout the year to ensure accuracy and transparency. Engaging with your landlord or property management team regularly can help address any discrepancies or concerns regarding it promptly.

Implementing cost-saving measures, such as energy-efficient upgrades or renegotiating service contracts, can also help mitigate escalating CAM costs. By staying proactive and informed about your CAM charges, you can better control your business budget and avoid unexpected financial burdens down the line.

CAM Charges: Breaking Down the Complexities for Business Owners

Navigating the complexities of it can be a challenging task for business owners leasing commercial spaces. Understanding the breakdown of these charges is crucial to effectively managing your budget and avoiding unexpected costs.

It typically cover expenses related to common area maintenance, such as landscaping, snow removal, property taxes, insurance, and utilities for shared spaces within a commercial property. It’s important to carefully review your lease agreement to identify what specific expenses are included in the CAM charges.

Business owners should also be aware of how they are calculated by landlords. These calculations can vary depending on factors like square footage or percentage of space occupied by the tenant. Being proactive in monitoring these costs can help prevent any discrepancies or overcharges.

To navigate through the complexities of it, consider seeking clarification from your landlord or professional assistance if needed. By staying informed and actively involved in understanding these fees, you can better manage your business budget and ensure transparency in your lease agreements.

The True Cost of CAM Charges: Insights for Commercial Tenants

When it comes to commercial leases, understanding the true cost of it is crucial for tenants. These charges can significantly impact a business’s budget and bottom line. Many tenants underestimate the full extent of CAM fees, which cover maintenance and operating expenses for common areas within a commercial property.

It can include expenses such as landscaping, snow removal, security, repairs, insurance premiums, and more. It’s essential for tenants to carefully review their lease agreements to identify what specific costs are included in them.

Being aware of the potential fluctuations in it year over year is also important. Tenants should be prepared for possible increases based on factors like inflation or unexpected maintenance needs within the property.

Taking proactive measures to manage and negotiate it can help mitigate financial surprises down the road. By staying informed and engaged with landlords regarding these fees, tenants can better control their overall leasing costs and protect their business budgets from unforeseen expenses related to common area maintenance fees.

CAM Charges 101: Simplifying Common Area Maintenance Fees

CAM charges, also known as Common Area Maintenance fees, are a critical aspect of commercial leases that tenants need to understand thoroughly. These charges cover the costs associated with maintaining shared spaces within a commercial property, such as lobbies, hallways, parking lots, and landscaping.

It’s essential for business owners to grasp the different types of expenses included in it. These can range from cleaning services and repairs to insurance premiums and utilities for common areas. By breaking down these components, tenants can better comprehend where their money is going.

Calculating it requires attention to detail and understanding the specific terms outlined in your lease agreement. Proper management of it involves monitoring expenses closely and ensuring transparency from landlords regarding any potential increases or additional fees throughout the lease term.

Navigating through it may seem complex at first glance. Still, with a clear understanding of what they entail and proactive communication with landlords when negotiating terms can help alleviate any uncertainties or surprises down the line.

Conclusion

As we wrap up our discussion on it, it’s important to remember that these fees can significantly impact your business budget. Understanding the different types of it and how they are calculated is crucial for effective cost management.

Negotiating with landlords on it can be a strategic move to control expenses and ensure fairness in the lease agreement. Exploring alternative options to minimize or avoid it altogether could also be beneficial for your bottom line.

Navigating through the complexities of it requires vigilance and proactive management. By staying informed and actively monitoring these costs, you can better anticipate their impact on your financial resources.

Remember, being aware of the true cost implications of it is key for commercial tenants looking to optimize their budgets effectively. Stay educated, stay proactive, and make informed decisions to manage these expenses strategically in your business operations.

FAQs

Q: What are CAM charges?

A: Common Area Maintenance (CAM) charges are fees paid by tenants in commercial leases to cover the costs of maintaining shared spaces like lobbies, hallways, parking lots, and more.

Q: How can businesses calculate CAM charges?

A: CAM charges are typically calculated based on a tenant’s proportionate share of the total building or property expenses. This is usually outlined in the lease agreement.

Q: Can CAM charges be negotiated with landlords?

A: Yes, it is possible to negotiate it with landlords before signing a lease. Businesses should carefully review and discuss these fees during lease negotiations.

Q: Are there alternatives to including CAM charges in business budgets?

A: Some businesses may opt for gross leases where all expenses, including CAM charges, are included in the rent. Others may negotiate caps on annual increases in CAM fees.

FAQs provide valuable insights into navigating the complexities of CAM charges and understanding their impact on your business budget. By being informed and proactive in managing these costs effectively, tenants can better control their overall leasing expenses while ensuring that common areas remain well-maintained for all occupants.

Visit More: Luv.trise

Visit Here: Googles 25e Verjaardag

Also Visit: kisskh.me