In the complex realm of financial markets, indexnasdaq: .ixic stands out, beckoning us to explore the patterns and understanding of the Nasdaq Composite Index. To fully grasp the impact of the Nasdaq Composite on the global financial scene, it is necessary to understand the relevance of the .IXIC extension.

In the complex realm of financial markets, indexnasdaq: .ixic stands out, beckoning us to explore the patterns and understanding of the Nasdaq Composite Index. To fully grasp the impact of the Nasdaq Composite on the global financial scene, it is necessary to understand the relevance of the .IXIC extension.

Indexnasdaq: .ixic: How Nasdaq Composite Was Born

The formation of the Nasdaq Composite was a watershed event in the evolution of the stock market. A more modern and efficient stock market was urgently needed, therefore it was founded in 1971 to meet that demand. Let’s explore the intriguing origin story of the Nasdaq Composite.

Conventional stock markets were struggling in the late 1960s to stay up with the lightning-fast development of new technologies. With a dramatic increase in the desire for easier and faster trading choices, the shortcomings of the current methods were more and more obvious.

Here, the necessity for a fresh and inventive platform was acknowledged by the National Association of Securities Dealers (NASD), a group that served as the OTC market’s self-regulatory authority. An online stock exchange that makes use of state-of-the-art technology to facilitate faster trades was the original goal.

The first electronic stock market in the world, the Nasdaq Composite, was formally inaugurated on February 8, 1971. Nasdaq did not use the same physical trading floor as other conventional exchanges. In reality, it was totally computer-based and ran as an electronic system. This innovative method broke new ground by doing away with the open outcry mechanism that has long been standard in financial transactions.

Companies of all sizes and in all industries are welcome on Nasdaq, which is reflected in its composite structure. Nasdaq is widely recognised as a gauge for the overall stock market, particularly for technology equities, thanks in part to its diverse membership.

Indexnasdaq: .ixic: Nasdaq Essentials :.IXIC

A wide range of enterprises, not limited to tech heavyweights, make up the core of.IXIC. In this section, we will go over the fundamentals of Nasdaq, which will help you understand how the Composite Index represents different industries.

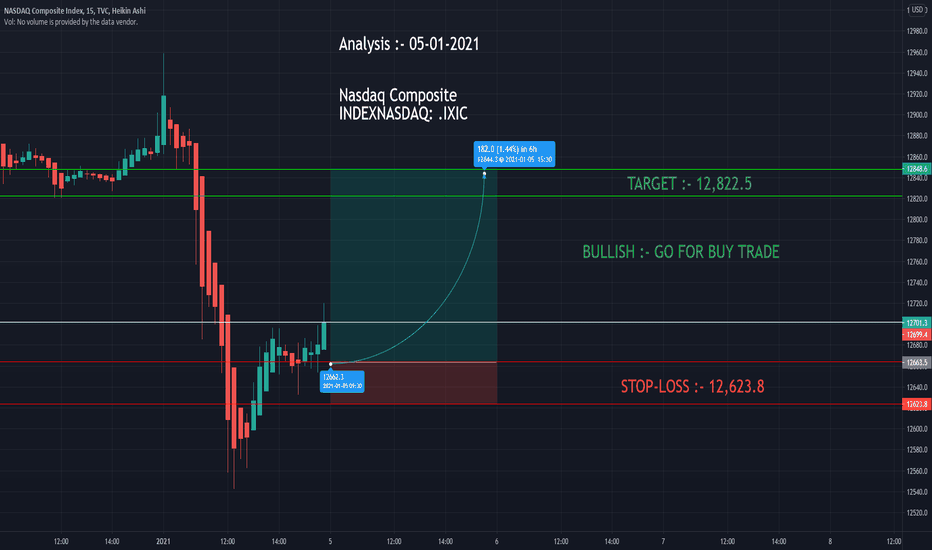

Indexnasdaq.IXIC Developments and Data from the Market

To fully utilize.IXIC, one must be adept at accessing real-time data, recognising trends, and evaluating how these factors affect investment plans. Learn about the ever-changing.IXIC patterns and how you can use this information to your advantage as an investor in this section.

Indexnasdaq: .ixic: Exploring Nasdaq’s Complexity

As we analyse the ever-changing Nasdaq, the word “burstiness” becomes quite important. We go into the idea and investigate the effects of Nasdaq burstiness on market behaviour and the consequences it has for investors.

The Function of Confusion in the Financial Markets

A key component of uncertainty in Nasdaq:.IXIC is perplexity. In order to help investors make educated decisions in the face of ambiguity, this part analyses financial market confusion.

Using Nasdaq’s Sub-Indexes

If you’re looking for a more sector-specific perspective, Nasdaq offers sub-indices in addition to the Composite Index. This section provides a synopsis of the Nasdaq sub-indices and the industry information they yield.

Nasdaq and the Dot-com Boom:

The dot-com boom and other historical events have permanently etched themselves upon Nasdaq. How the dot-com boom affected Nasdaq is discussed here .IXIC, analysing its ascent and decline to better understand the market now.

Contributions of IXIC to Technological Progress

The development of new technologies has been accelerated by Nasdaq. We look into how in this part.With its help, IXIC has paved the way for technical progress, which has influenced innovation and changed the face of new technology.

Indexnasdaq: Nasdaq’s International Reach :.IXIC

Outside of the United States, Nasdaq has an impact. This section delves into the global impact of.IXIC, taking a look at Nasdaq’s influence on overseas markets and the global corporations listed.

Nasdaq Investments :.IXIC

For investors, what is the appeal of the .IXIC domain? Investors thinking about putting their money into Nasdaq will find useful information in this part, which explores the platform’s allure for tech-centric investors as well as diversification techniques.

Nasdaq’s Resilience: A Guide Through Economic Storms

Throughout its history, Nasdaq has proven to be resilient, even in the face of economic downturns. The way this is done is detailed here. Investors in today’s volatile financial markets can learn from IXIC’s success in riding out economic storms.

Indexnasdaq: .ixic: Nasdaq’s Impact on Market Attitudes

In addition to statistics, Nasdaq affects market mood. We will look at how in this part. The confidence of investors is influenced by IXIC, which in turn affects market patterns.

How Nasdaq Affects New Businesses

Getting a startup listed on Nasdaq can alter everything. This section delves into the reasons why Nasdaq is attractive to new businesses and how this affects startup ecosystems.

Indexnasdaq: Final Thoughts

Finally, exploring indexnasdaq:.ixic reveals an intriguing environment of market movements and economic trends. The Nasdaq Composite Index, abbreviated as.ixic, is a potent indication, particularly in the innovation and technology sectors.

Investors can gain useful insights into the ever-changing market circumstances through.ixic, which has been there since the early 1970s and was the first electronic stock market. Now, it covers a multitude of companies and is a complete index. Its concentration on tech equities makes it a measure of the tech industry as a whole, impacting both personal investment choices and public views of the economy.

A thorough familiarity with economic statistics, company profits, and world events is necessary for navigating the.ixic market. Investors can use this information to their advantage by developing strategies, reducing risks, and taking advantage of market opportunities.

Investors must approach.ixic with a balanced perspective, despite its critical position in the financial world. To make educated investment decisions, it is important to identify and correct frequent misunderstandings, monitor patterns and trends, and study successful case studies.

In the ever-evolving world of finance, indexnasdaq:.ixic is a key player that reflects market sentiment and provides possibilities for those that approach it strategically and diligently.

Indexnasdaq: FAQs

Are tech aficionados the only ones who should invest in indexnasdaq: .ixic?

Even though.ixic is heavily weighted in technology, it covers a wide range of industries, thus it’s suitable for investors with a variety of portfolios.

Around what intervals is.ixic rebalanced?

To maintain a true reflection of the market,.ixic is rebalanced periodically, usually every three months.

Do regular people have the option to buy.ixic coins directly?

Not at all;.ixic is just an index, but there are funds that aim to replicate its performance.

How does.ixic factor into the international monetary system?

.ixic is a leading economic indicator that affects how the world sees technology and stock markets in general.

How can one lessen the impact of.ixic hazards on investors?

To mitigate the dangers of investing in.ixic, one should diversify their holdings, do their homework, and keep up with market developments.

for further information visit:https://www.fabulaes.com/