To the dazzling world of precious metals and the captivating journey of Greatland Gold share price! As investors seek out opportunities in a volatile market, the recent rally in Greatland Gold’s share price has sparked excitement and intrigue. Join us as we dive into the factors driving this surge, explore potential risks and rewards, and uncover expert insights on what lies ahead for both Greatland Gold and the precious metal sector as a whole. Get ready to embark on a golden adventure filled with valuable information and strategic tips for maximizing your investment potential!

Recent Share Price Rally and Factors Behind It

Greatland Gold has been making waves in the precious metals market with its recent share price rally, capturing the attention of investors far and wide. The surge in Greatland Gold’s share price can be attributed to a combination of factors that have ignited investor interest and optimism.

One key driver behind the recent rally is the company’s successful exploration activities, uncovering promising gold deposits that have bolstered confidence in its long-term growth potential. Additionally, strategic partnerships and collaborations with industry leaders have further fueled excitement surrounding Greatland Gold’s prospects.

Market dynamics and macroeconomic trends also play a role in influencing share prices, as fluctuations in commodity prices and geopolitical events can impact investor sentiment towards precious metal investments. As investors continue to closely monitor developments within the sector, Greatland Gold remains positioned to capitalize on opportunities for further growth and value creation.

Opportunities for Investors in the Precious Metal Sector

Are you considering diversifying your investment portfolio? The precious metal sector offers unique opportunities for investors seeking stability and growth. With the recent surge in demand for safe-haven assets, precious metals like gold, silver, and platinum have garnered significant attention from investors looking to hedge against market volatility.

Investing in precious metals can provide a hedge against inflation and economic uncertainties. These assets tend to retain their value even during times of market turbulence, making them attractive options for long-term wealth preservation.

Moreover, the global macroeconomic environment plays a crucial role in driving the prices of precious metals. Factors such as geopolitical tensions, currency fluctuations, and central bank policies can impact the supply and demand dynamics of these commodities.

For investors willing to ride out short-term fluctuations, the precious metal sector presents an avenue for potential capital appreciation over time. Conduct thorough research and consider diversifying your portfolio with exposure to precious metals to capitalize on this promising investment opportunity.

Potential Risks of Investing in Precious Metals

Investing in precious metals like Greatland Gold can offer lucrative opportunities, but it’s essential to be aware of the potential risks involved. One risk is the volatility of metal prices, which can fluctuate based on various factors such as economic conditions and geopolitical events. This price instability can lead to sudden losses for investors who are not prepared for market fluctuations.

Another risk to consider is regulatory changes that may impact the mining industry or the trading of precious metals. Shifts in government policies or environmental regulations could affect production costs and ultimately influence the value of your investment in Greatland Gold shares.

Additionally, investing in precious metals comes with liquidity risks, as these assets may not always be easy to sell quickly at a fair price. Market conditions can impact how easily you can convert your investment into cash when needed, potentially affecting your overall financial strategy.

It’s important for investors to conduct thorough research and diversify their portfolios to mitigate these risks associated with investing in precious metals like Greatland Gold.

Expert Forecasts for Greatland Gold and the Precious Metal Market

Experts in the precious metal market have been closely monitoring Greatland Gold and its share price movements. With a keen eye on both macroeconomic trends and company-specific developments, these experts provide valuable insights for investors looking to navigate the unpredictable nature of the market.

Analysts predict that the ongoing global economic uncertainties may continue to drive investors towards safe-haven assets like gold, benefiting companies like Greatland Gold. The potential for geopolitical tensions or inflationary pressures could further boost demand for precious metals in the coming months.

Moreover, with advancements in technology and increasing sustainability concerns, there is growing interest in mining companies that adhere to responsible practices. Greatland Gold’s commitment to ethical mining operations could position it favorably among environmentally conscious investors seeking long-term value.

As experts analyze various factors influencing the precious metal market, including supply chain disruptions and currency fluctuations, their forecasts play a crucial role in shaping investment decisions. By staying informed about expert opinions on Greatland Gold and industry trends, investors can make well-informed choices when navigating this dynamic sector.

Diversifying Your Investment Portfolio with Precious Metals

Looking to diversify your investment portfolio? Consider adding precious metals like Greatland Gold to the mix. Precious metals have long been considered a safe haven for investors during times of economic uncertainty.

Adding these assets to your portfolio can help protect against market volatility and inflation. With their intrinsic value, precious metals provide a hedge against currency fluctuations and geopolitical risks.

Investing in Greatland Gold shares can offer exposure to the potential upside of gold mining operations. The company’s exploration projects show promising results, making it an attractive option for those looking to tap into the lucrative world of precious metals.

By diversifying with Greatland Gold shares, you spread risk across different asset classes, reducing overall portfolio volatility. Plus, as demand for precious metals continues to rise globally, investing in companies like Greatland Gold could prove rewarding in the long run.

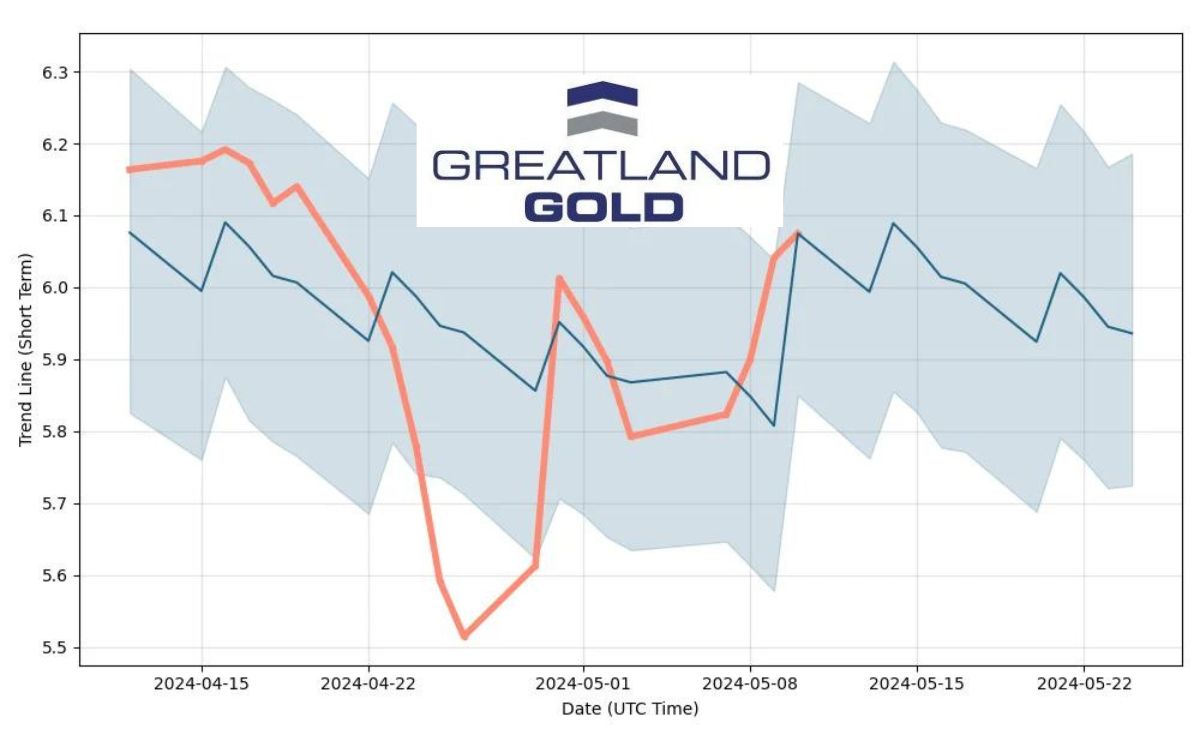

Uncovering Hidden Gems: Analyzing Greatland Gold Share Price Trends

Have you ever felt the thrill of discovering a hidden gem in a sea of investments? Greatland Gold’s share price trends may just be that treasure waiting to be uncovered.

Analyzing these trends is like peeling back layers of complexity to reveal the potential for growth and success. It requires attention to detail, strategic thinking, and a keen eye for market dynamics.

As you delve into the intricacies of Greatland Gold’s share price trends, you’ll start to see patterns emerge – patterns that could hold the key to unlocking value and maximizing returns on your investment.

By closely examining historical data, market sentiment, and industry developments, you can gain valuable insights into where Greatland Gold’s share price might be headed next. This analysis is not just about numbers; it’s about understanding the story behind the fluctuations.

Uncovering hidden gems isn’t easy, but with dedication and perseverance, investors can position themselves to capitalize on opportunities in the precious metal sector. So keep digging deeper and stay ahead of the curve when it comes to analyzing Greatland Gold’s share price trends.

Golden Opportunities: Strategies for Maximizing Greatland Gold Share Price

Looking to capitalize on the upward momentum of Greatland Gold’s share price? Here are some strategies for maximizing your investment potential. Staying informed about market trends and company developments is key. Conduct thorough research to make well-informed decisions.

Consider diversifying your portfolio to reduce risk. By spreading your investments across different assets, you can mitigate potential losses from any single investment. Additionally, keep a close eye on precious metal prices and global economic factors that may impact the value of gold.

Timing is crucial when it comes to buying and selling shares. Monitor the market closely and be prepared to act swiftly based on fluctuations in share price. Stay patient and avoid making impulsive decisions based on short-term market movements.

Consider seeking advice from financial experts or utilizing tools like technical analysis to identify potential entry and exit points for maximizing returns on your Greatland Gold investment.

From Mines to Markets: Navigating Greatland Gold Share Price Fluctuations

Navigating the fluctuations in Greatland Gold’s share price is akin to a journey from the depths of mines to the bustling markets. Just as miners extract precious metals from the earth with uncertainty, investors must weather market volatility. The rise and fall of share prices mirror the unpredictability of mining operations, affected by various external factors.

Understanding these fluctuations requires a keen eye on market trends, company performance, and global economic conditions. Like miners prospecting for gold veins underground, investors must track indicators that signal potential shifts in Greatland Gold’s share price trajectory.

Staying informed about regulatory changes, industry developments, and geopolitical events can help navigate through turbulent times. Much like how miners adapt their techniques to changing geological conditions, investors need to adjust their strategies based on evolving market dynamics.

In this intricate dance between supply and demand forces lies opportunities for astute investors who can spot patterns amidst the chaos. By embracing volatility rather than fearing it, one can potentially unlock hidden value within Greatland Gold’s share price movements.

Prospering in Precious Metals: Unlocking Value with Greatland Gold Share Price

Investing in precious metals can be a lucrative opportunity for those looking to diversify their portfolios and hedge against market volatility. Greatland Gold, with its recent share price rally, has garnered attention from investors seeking to unlock value in the precious metal sector.

By understanding the factors driving Greatland Gold’s share price movements, investors can make informed decisions on when to buy or sell their positions. Conducting thorough research on the company’s mining projects and potential growth prospects is crucial in maximizing returns.

With fluctuations in global economic conditions and geopolitical tensions impacting precious metal prices, staying updated on market trends is essential for navigating investments successfully. Keeping a close eye on industry news, commodity prices, and macroeconomic indicators can provide valuable insights into potential opportunities for growth.

In conclusion of this section – Leveraging expertise and strategic analysis will be key in unlocking value with Greatland Gold share price trends.

Market Insights: Predicting Future Greatland Gold Share Price Movements

As investors in the precious metal sector, staying informed about market trends is crucial. Predicting future Greatland Gold share price movements involves analyzing a variety of factors. Market insights play a key role in understanding the potential trajectory of this stock.

Factors such as gold prices, mining developments, and global economic conditions can all impact Greatland Gold’s share price. Conducting thorough research and monitoring industry news can provide valuable insights into potential price movements.

Technical analysis tools like moving averages and trendlines can also help predict future stock performance. By studying historical data and patterns, investors can make more informed decisions about buying or selling shares of Greatland Gold.

It’s important to remember that no prediction is foolproof; the market is inherently unpredictable. However, by combining research, analysis, and expert opinions, investors may gain a clearer picture of where Greatland Gold’s share price could be headed next.

Diving Deep: Exploring Factors Impacting Greatland Gold Share Price

The Greatland Gold share price is like a hidden treasure waiting to be discovered by savvy investors. To truly understand the factors influencing its value, one must dive deep into the world of precious metals and mining industries.

Exploring the geological potential of Greatland Gold’s projects provides valuable insights into future prospects. The company’s strategic partnerships and exploration efforts play a crucial role in shaping market sentiment towards its shares.

Global economic trends, geopolitical events, and even environmental regulations can all impact the price of precious metals, thus affecting Greatland Gold’s performance on the stock market.

Analyzing supply and demand dynamics for gold and other precious metals is essential for predicting how external factors may influence Greatland Gold share prices in the long run.

By delving into these intricate details, investors can make informed decisions about whether or not to capitalize on this promising investment opportunity that Greatland Gold presents.

Shining Bright: The Story Behind Greatland Gold Share Price Success

Greatland Gold’s share price success story is a tale of perseverance and strategic decision-making. It all began with the company’s focus on exploring and developing precious metal deposits in key regions, which captured the attention of investors seeking exposure to the lucrative mining sector.

The management team’s expertise and commitment to operational excellence have been integral to Greatland Gold’s rise in the market. By consistently delivering on exploration milestones and demonstrating strong project potential, they have instilled confidence among shareholders.

Furthermore, strategic partnerships and collaborations have played a crucial role in enhancing Greatland Gold’s visibility and credibility within the industry. These alliances have not only provided access to additional resources but also opened up new avenues for growth and expansion.

It is this combination of vision, execution, and collaboration that has propelled Greatland Gold towards its current position as a notable player in the precious metals space. As investors continue to monitor its progress closely, there is no doubt that the company’s share price trajectory will remain an intriguing narrative to follow.

Investing in the Future: Understanding Greatland Gold Share Price Dynamics

Investing in the future involves understanding the dynamics that drive Greatland Gold share price movements. The company’s performance is intricately linked to factors such as gold prices, exploration results, and market sentiment. Monitoring these variables can provide valuable insights into potential investment opportunities.

Greatland Gold’s share price dynamics are influenced by macroeconomic trends, geopolitical events, and industry news. Staying informed about these external factors can help investors anticipate changes in the stock’s value and make well-informed decisions.

Technical analysis plays a crucial role in understanding share price patterns and identifying potential entry or exit points. By studying historical data and chart patterns, investors can gain a better grasp of Greatland Gold’s price behavior and potentially capitalize on market trends.

Additionally, keeping an eye on competitors’ performance, regulatory developments, and project milestones can offer further clarity on Greatland Gold’s positioning within the precious metals sector. This comprehensive approach to analyzing share price dynamics can assist investors in navigating market fluctuations effectively while maximizing potential returns.

Golden Pathways: Leveraging Opportunities in Greatland Gold Share Price Trends

Investors seeking golden opportunities may find value in leveraging Greatland Gold share price trends. Understanding the market dynamics and exploring potential pathways can lead to strategic investments.

Analyzing historical data and identifying emerging patterns could offer insights into future price movements. By staying informed about factors influencing the precious metal sector, investors can make well-informed decisions.

Diversifying portfolios with a mix of assets, including Greatland Gold shares, may help mitigate risks and optimize returns. Keeping an eye on market trends and adapting strategies accordingly is key to navigating fluctuations in share prices.

Staying proactive in monitoring developments within the company and broader industry can provide a competitive edge. Seizing opportunities presented by favorable market conditions could potentially result in significant gains for savvy investors.

Conclusion: Is Greatland Gold a Good Investment Opportunity?

As you navigate the intricate world of investing, considering Greatland Gold as a potential opportunity requires careful evaluation. The company’s performance in the precious metal market has shown promise, attracting both seasoned and novice investors alike. With fluctuations in share prices and market dynamics playing a crucial role, it’s essential to conduct thorough research before making any investment decisions.

Analyzing trends, expert forecasts, and risk factors can provide valuable insights into the potential growth trajectory of Greatland Gold shares. Diversifying your investment portfolio with exposure to precious metals may offer stability and hedging benefits against economic uncertainties. By leveraging opportunities presented by Greatland Gold’s share price movements, investors can strategically position themselves for long-term gains.

Understanding the underlying dynamics driving Greatland Gold’s performance is key to unlocking value in this investment opportunity. Stay informed, stay vigilant – and let your investment journey unfold with prudence and foresight.

FAQs

Q: Is Greatland Gold a good investment opportunity?

A: While investing in precious metals can offer potential benefits, including portfolio diversification and hedging against economic uncertainties, it is essential to conduct thorough research and consider the risks involved before making any investment decisions. Greatland Gold’s share price rally reflects positive market sentiment towards the company, but investors should carefully assess their risk tolerance and investment goals before diving into this sector.

By staying informed about market trends, understanding the factors influencing share prices, and seeking expert advice when needed, investors can navigate the volatile nature of precious metal investments more effectively. Remember that every investment carries risks, so it’s crucial to approach them with caution and diligence to maximize your chances of success in this dynamic market landscape.