NFTs (non-fungible tokens) are one-of-a-kind cryptographic assets representing ownership of anything imaginable: unique artwork, in-game items like avatars, domain names, fractionalized real estate, or even Nike sneakers from a limited-run fashion line. These collectibles can skyrocket as they’re associated with a prestigious brand or event.

Supply and Demand

NFTs are unique digital assets that can be bought with fiat or various cryptocurrencies and confer digital bragging rights. Some examples are digital art, virtual plots of land, or collectible items from popular games. The popularity of NFTs has created a growing market for free NFT drop, where a collection is released with an incentive to buy and earn them. While most NFT drops don’t explode in value, some do. One way to encourage participation is by giving free NFTs to those participating in a public drop. This is often done by giving each participant a randomly generated NFT in a collection that will be revealed later. The NFTs can then be traded for new NFTs in the same collection. Another method to increase the number of participants is a centralized, off-chain reservation system where team members can blacklist bots and only give the NFTs to authenticated people. This is a growing area in web3. However, proving that a user is a human without violating decentralization remains a challenge. Even if these NFTs are free, the creator must still pay gas fees to mint and transfer them in their blockchain. This can add up quickly, especially if many NFTs are being minted and transferred.

Market Forces

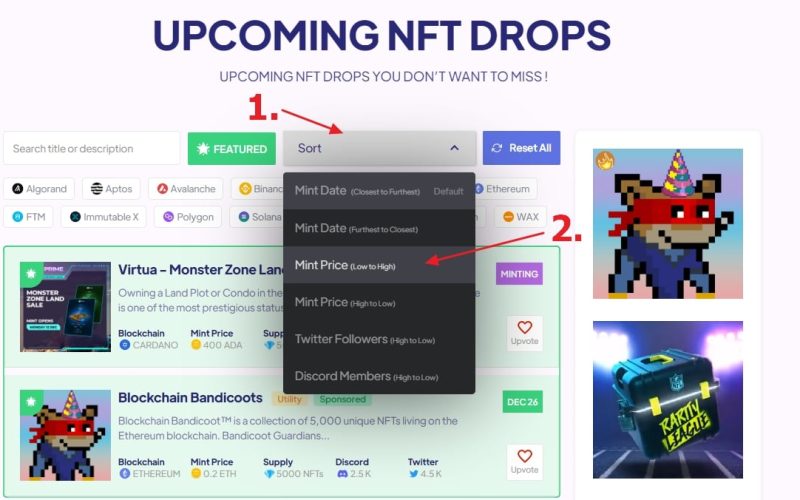

NFT drops must balance two competing forces — maximizing sales and building a community that gives the drop meaning. To maximize sales, NFTs can be discounted or bundled to create special offers such as bundle packs or mystery boxes. A community that supports the drop may help increase its value by sharing content or promoting the item on social media. A rare NFT may attract collectors and influence its resale price. Non-fungible tokens that are one of a kind or evoke significant cultural or historical significance may be worth more than other NFTs with similar traits. While NFTs can be traded on secondary markets, the most lucrative time to buy NFTs is during a project’s initial drop. By following NFT drop calendars, fans can get in on a new release before the secondary market prices spike. Popular NFT drops can also cause surges in gas fees on the Ethereum blockchain. This can cost buyers money and limit the value creators receive from resale. Many projects launch on alternative blockchains offering lower transaction fees to avoid this.

Profitability

NFT drops aren’t just fun for the community and are highly profitable. Whether through token sales, airdrop, or trading activity on the NFT marketplace Kraken, the developers behind these projects generate revenue and build a sustainable model for their businesses. A common practice in the blockchain industry is offering an initial token sale for a discount, allowing early adopters to purchase them at a lower price before the market prices them up later. As with traditional works of art, determining a fair market value for NFTs is challenging. While it may be easier to determine the worth of an NFT created by a well-known artist, it is more difficult to assess the rarity of a collection of similar NFTs. Rarity is one of the critical factors that drive NFT prices. When an NFT is extremely rare, it attracts a higher price because of the law of supply and demand: more people are interested in acquiring it, driving its value. For collections with a wide range of traits, calculating NFT rarity can be tricky, but some tools can help.

Rarity

A non-fungible token’s rarity is the factor that drives its value. The overall number of NFTs in a collection and the unique qualities or traits that distinguish an individual NFT could make it less common, increasing its value. For example, a rare shoe worn by a celebrity might gain value as more people want to possess it. NFTs that commemorate historical events or sports victories also grow in value. One of the ways to evaluate an NFT’s rarity is by calculating its statistical rarity. This method takes all the traits on an NFT and averages them together. This gives the NFT a score based on the number of rare traits, with a single rare trait taking the highest weight. This method can have problems, however, as it may overvalue rare traits that aren’t very rare and undervalue those that are. To solve this problem, several tools have been created that give NFTs an objective rarity ranking.