The advent of FintechZoom Insights marks a watershed point in the rapidly developing field of financial technology in the lightning-fast world of finance and technology. It is crucial to lay the groundwork for comprehending the fast changes transforming the financial industry and the dynamic synergy between technology and finance as we begin our investigation.

Delving into the World of Fintech

The combination of “finance” and “technology,” or “fintech” for short, signifies the merging of these two fields. This section explains what financial technology is and how it came to be, as well as the elements that have contributed to its meteoric rise as a game-changer in the industry.

Zoom: A Major Figure in Fintech

As a platform that provides important insights into the complexities of financial technology, FintechZoom is at the forefront of this Fintech revolution. In this section, we will introduce FintechZoom and discuss how it contributes to understanding the ever-changing Fintech industry.

Technological Changes in the Financial Sector

Digging into the fundamentals is the key to grasping Fintech. In this section, we will take a closer look at the fundamentals of financial technology, namely how digital payments and automated financial advice services are changing the face of conventional banking.

How It Will Affect Conventional Banks

Traditional banking systems are being challenged and client expectations are being redefined by the disruptive influence of fintech. Highlighting changes in client tastes and the dynamic character of financial services, this part delves into the revolutionary effect Fintech has on conventional banking.

Zoom Insights: Revealing Patterns in Fintech

With the financial landscape constantly shifting, FintechZoom’s trend analysis becomes more important. This section explores the ways in which FintechZoom gives its users a better grasp of financial trends using predictive analytics and real-time market insights.

Blockchain Technology and Financial Technology Convergence

At the intersection of financial technology and blockchain, a formidable coalition is taking shape. Here we take a look at the possibilities for collaboration, with an emphasis on how this merging strengthens transaction security, promotes financial inclusivity, and adds to the larger blockchain revolution.

Overcoming Obstacles in Regulation

An essential part of the financial technology area is the regulatory environment. This section delves into the difficulties of Fintech legislation, highlighting the significance of security, collaboration, and compliance in creating an innovation-friendly atmosphere.

Impressions from FintechZoom Users

One of the reasons FintechZoom has been so successful is its dedication to making the platform easy to use. In order to provide a smooth and powerful experience for users, this section delves into the platform’s customization options, tools, and initiatives to improve financial literacy.

Fintech Solutions for Local Companies

Financial technology is not just for huge corporations; it also helps smaller ones. This section delves into the ways in which Fintech helps small businesses by levelling the playing field in terms of access to financing, simplifying financial processes, and encouraging business growth

Mobile Banking: A Journey Through Time

When it comes to expanding people’s access to banking services, mobile technology is crucial. This section delves into the history of mobile banking, examining how technology has changed the game for conventional banking models and looking ahead to its potential developments.

Financial Technology Network

The foundation of the financial technology ecosystem is partnerships and collaborations. In this section, we’ll take a look at how collaboration may drive innovation, create synergies, and advance the Fintech business.

A Look Into FintechZoom’s Future

This section delves into FintechZoom’s strategic strategy, offering a glimpse into the future. We may understand the forward-thinking elements driving FintechZoom’s progress by exploring the platform’s contributions to financial evolution and the breakthroughs that are just around the corner.

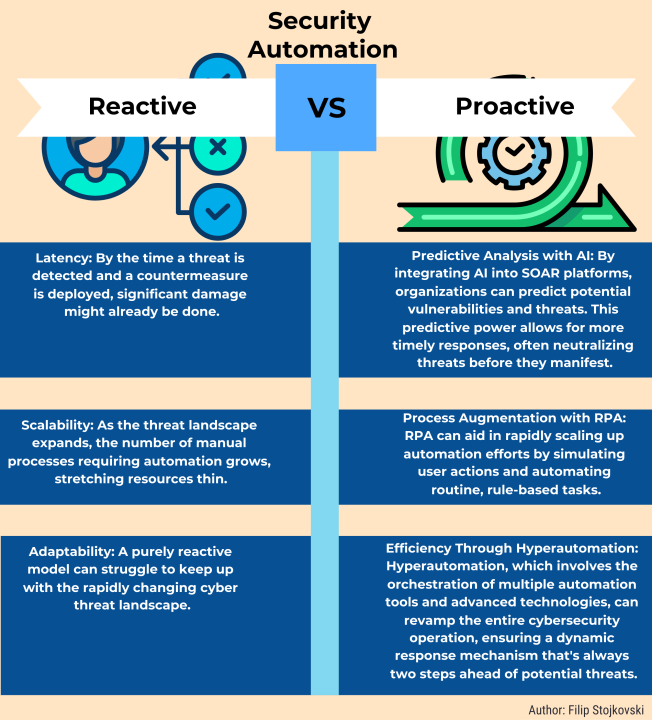

Dealing with Security Issues

When it comes to Fintech’s digital arena, security is key. This section discusses cybersecurity, explaining the steps done to protect online transactions and establish confidence in Fintech platforms.

Conclusion

With each turn of the page, “FintechZoom Insights: Navigating the Evolving Landscape of Financial Technology” takes the reader on a thrilling adventure through the ever-changing world of financial technology. Finally, this investigation has shown that the Fintech revolution represents a complete rethinking of our relationship with financial services, not merely a change in technology.

Through disrupting established banking systems and reshaping customer expectations, fintech—the intersection of finance and technology—has emerged as a game-changer. With its prominent position, FintechZoom stands out as a significant actor and a source of useful insights into the complexities of this dynamic industry.

Insights from FintechZoom peel back the layers of complexity inside the Fintech domain, from the disruptive impact on traditional banking to the interaction with blockchain technology. FintechZoom does more than just read the trends; it actively influences the future of financial technology with real-time market information, predictive analytics, and a dedication to user-friendly experiences.

Innovation in financial technology is a result of the ecosystem’s collaborative nature, which is shown through synergies and partnerships. A paradigm shift in the way we use financial services is signalled by the evolution of mobile banking, small enterprises gain empowerment, and regulatory hurdles are negotiated.

The future of financial technology is bright, according to FintechZoom’s strategic roadmap, which promises new developments. There will be a new era of possibilities brought forth by the commitment to financial evolution and technical improvements in the future vision.

Finally, “FintechZoom Insights” encourages us to welcome the revolutionary Fintech, adjust to the evolving financial scene, and value the teamwork that is driving innovation in the sector. Following the steps outlined in this article will help you take advantage of the benefits and avoid the pitfalls that come with the ever-changing world of financial technology.

Answers to Common Questions

How is FintechZoom different from more conventional financial platforms, and what is it anyway?

The ever-changing world of financial technology can be better understood with the help of FintechZoom, a dynamic platform. In contrast to more conventional financial platforms, FintechZoom provides advanced features such as predictive analytics, real-time market data, and an intuitive interface designed to meet the demands of today’s consumers.

What value does FintechZoom add to the ecosystem of financial technology companies?

FintechZoom is an integral part of the Fintech ecosystem because of the way it interprets trends, encourages partnerships, and helps shape the future of the industry. Financial technology developments are being propelled by collective intelligence, which FintechZoom joins in on through collaborations and synergies.

In what ways does Fintech shake up the established banking industry?

By bringing new, creative financial services and rethinking what customers expect from banks, fintech is shaking things up in the industry. Changes in the way people and companies interact with banks are a direct result of this revolutionary effect.

When it comes to online safety, how does FintechZoom handle things?

At FintechZoom, we prioritise security. Digital transactions are protected by the platform’s strong cybersecurity protections, which provide users faith in the safety of Fintech services.

Is fintech a good fit for small businesses? If yes, how?

Sure thing. By facilitating growth, simplifying financial processes, and increasing access to finance, fintech gives small firms a leg up. Small businesses can improve their overall success by using Fintech services to better manage their finances.

for further information visit:https://www.fabulaes.com/