AARP Medicare Supplement Insurance Plans assist cowl a number of your out-of-pocket fees that Medicare doesn`t pay.

While Medicare Parts A and B (additionally called “Original Medicare”) cowl a few fitness care fees, they do not pay for everything. That’s wherein an AARP Medicare Supplement Insurance Plan, insured via way of means of UnitedHealthcare Insurance Company, may also assist. Medicare Supplement Insurance Plans (additionally called “Medigap”) from personal insurers supplement your Original Medicare insurance.

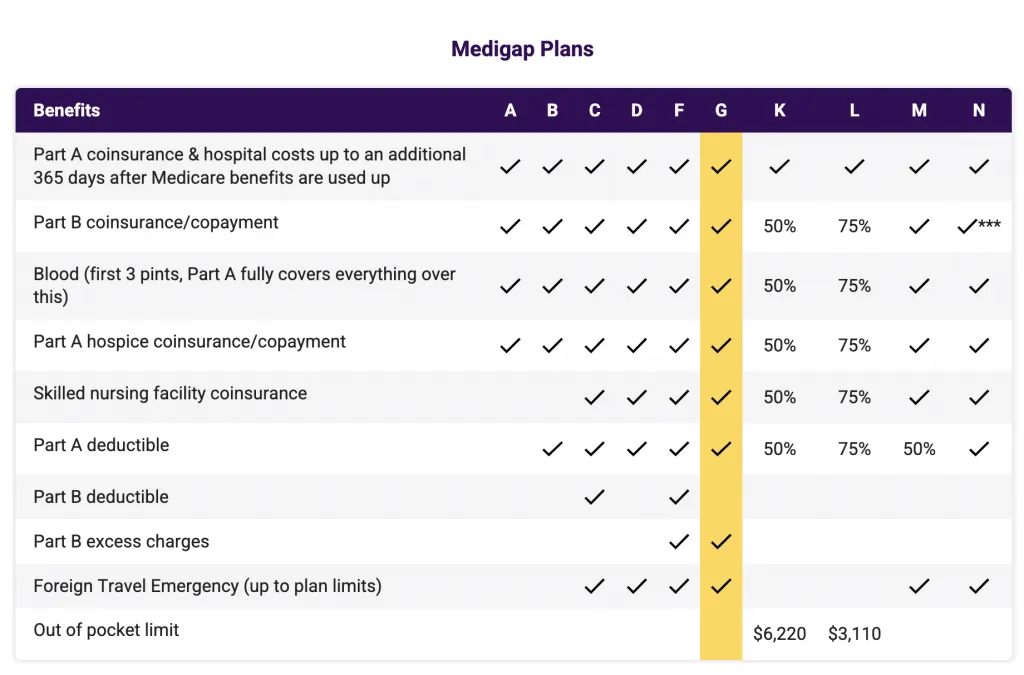

Medicare Supplement Plan (Medigap) Benefits

Medicare complement coverage plan (Medigap) blessings are standardized and set via way of means of the federal government. That approach the primary advantage shape for every plan is precisely the equal, regardless of which coverage enterprise is promoting it to you. Some plan capabilities are:

A desire of plans to fulfill your wishes and budget—now and withinside the future.

You’re capable of preserve your very own physician with out community restrictions, so long as they receive Medicare sufferers.

Coverage is going with you whilst you journey withinside the U.S.

You are assured insurance for life.*

Rates are situation to extrade. Any extrade will practice to all contributors of the equal elegance insured beneathneath your plan who live to your state.

You may also go to any expert who accepts Medicare sufferers with out a referral.

What is Medicare Supplement Insurance?

*As lengthy as you pay your rates while due and also you do now no longer make any fabric misrepresentation whilst you practice for this plan.

Why AARP Medicare Supplement Insurance Plans?

UnitedHealthcare is the unique insurer of AARP Medicare Supplement Insurance Plans. These are the most effective coverage plans in their type encouraged via way of means of AARP.** Plus…

Any service or product that consists of the AARP call has been cautiously evaluated. It’s been decided on as one which meets the excessive provider and actual high-satisfactory requirements of AARP.**

UnitedHealthcare and associates cowl extra human beings with Medicare complement plans national than another man or woman coverage carrier.^

What are the AARP Medicare Supplement plan alternatives available?

There are a number of of factors to reflect on consideration on while you are looking at Medicare complement plans. Consider how a good deal you may pay for offerings, like medical institution remains or physician visits, and what sort of you are inclined to spend for your month-to-month plan top rate and out-of-pocket fees.

Benefits and fees range relying at the plan chosen.

Note: In Massachusetts, Minnesota and Wisconsin, there are specific standardized plan alternatives available.

Only candidates first eligible for Medicare earlier than 2020 may also buy Plans C and F.

Plans A and B: Lower Benefits, Higher Out-of-Pocket

Medicare Supplement Plan A gives simply the Basic Benefits whilst Plan B covers Basic Benefits plus a advantage for the Medicare Part A deductible. The Medicare Part A deductible can be one in all your biggest out-of-pocket fees in case you want to spend time in a medical institution. Plans A and B have decrease month-to-month rates with better out-of-pocket fees for such things as Skilled Nursing Facility Coinsurance, Medicare Part B Excess Charges, and Foreign Travel Emergency Care.

Plans C1, F1, and G: Higher Benefit Level, Higher Premium

Plans C, F, and G provide the maximum supplemental insurance, paying lots of your out-of-pocket fees for Medicare-permitted offerings. Consider this kind of plans in case you are inclined to pay a better month-to-month top rate in change for extra included blessings and decrease out-of-pocket fees.

1Note: You may also most effective practice for Plans C and F in case you have been first eligible for Medicare earlier than 2020.

Plans K and L: Lower Premium, Cost Sharing

Plans K and L are value-sharing plans presenting decrease month-to-month rates. The rates are decrease due to the fact they pay a percent of the coinsurance as opposed to the total coinsurance amount. Once the out-of-pocket restrict is reached, those plans pay 100% of included offerings for the relaxation of the calendar year.

Plan N: Copay Structure, Mid-Range Premium (Plan N)

Plan N covers the Medicare Part B coinsurance however you pay copayments for included physician workplace and emergency room visits in change for a mid-variety month-to-month top rate.

What are the AARP Medicare Supplement plan alternatives available?

There are a number of of factors to reflect on consideration on while you are looking at Medicare complement plans. Consider how a good deal you may pay for offerings, like medical institution remains or physician visits, and what sort of you are inclined to spend for your month-to-month plan top rate and out-of-pocket fees.

Benefits and fees range relying at the plan chosen.

When can I practice for a Medicare complement (Medigap) plan?

Once you are enrolled in Medicare Parts A and B, you may practice for a Medicare complement coverage plan at any time.2 Your popularity is assured in case you practice all through your Medigap Open Enrollment Period. This 6-month duration starts off evolved on the primary day of the month wherein you are both.

At least age sixty five or older, and Enrolled in Medicare Part B

There can be different conditions wherein you’ll be assured popularity.

It facilitates to apprehend your fitness care wishes and the way you’ll use a Medicare complement coverage plan. That will make it simpler to select a plan with the proper value and advantage shape for you.